At the beginning of June, I had exciting discussions with several battery industry experts at Battery Minerals & Supply Chain 2023 in Toronto, Canada. We face two enormous challenges. We need much more high-quality carbon products than today for the industrial value chain, and we need to create supply chains unaffected by geopolitical challenges. Once new regulation for climate protection is made in Canada and, for instance, in the EU, the demand for a range of carbon products will increase even faster.

The main reason for the increasing demand is transport. Passenger electric cars are surging in popularity. International Energy Agency estimates that 13% of new vehicles sold in 2022 will be electric. The number of electric passenger vehicles (EVs) sold will rise from 7 million in 2021 to 21 million in 2025. The fleet of EVs on the road will hit 77 million by 2025 and 229 million by 2030, estimates BNEF. Electric cars need batteries.

Massive need for carbon in batteries

Carbon plays a critical role in lithium-ion batteries as it is used in various components to enhance the battery’s performance. Using carbon in lithium-ion batteries enables efficient lithium-ion intercalation, enhances electrical conductivity, improves cycling stability, and ensures the overall performance and longevity of the battery. Manufacturers use carbon in lithium-ion batteries in several ways:

1. Anode Material: Lith-ion batteries’ anode (negative electrode) is typically made of carbon-based materials such as graphite. Graphite can intercalate lithium ions, allowing them to be stored and released during charging and discharging cycles. The carbon structure of graphite provides a stable framework for accommodating lithium ions, enabling efficient and reversible lithium-ion intercalation.

2. Conductive Additive: Carbon-based materials, such as carbon black or carbon nanotubes, are often added to the electrode formulations as conductive additives. These additives improve the electrical conductivity of the active electrode materials, facilitating the movement of electrons during the charge and discharge processes. Carbon additives ensure efficient electron transfer, which is crucial for the battery’s overall performance.

3. Carbon-Coated Electrodes: Carbon coatings are applied to the active electrode materials to further enhance lithium-ion batteries’ performance. The carbon coating helps improve the stability and cycling performance of the electrodes by providing a protective layer, preventing undesired reactions with the electrolyte, and maintaining structural integrity. Carbon coatings also enhance the electrical conductivity of the electrode, facilitating efficient charge and discharge rates.

4. Current Collectors: Carbon-based materials, such as carbon or carbon-coated metal foils, are commonly used as current collectors in lithium-ion batteries. Current collectors act as pathways for the flow of electrons between the electrodes and the external circuit. Carbon-based current collectors are lightweight, have good electrical conductivity, and exhibit chemical stability, making them suitable for this purpose.

Carbon nanomaterials improve supercapacitors

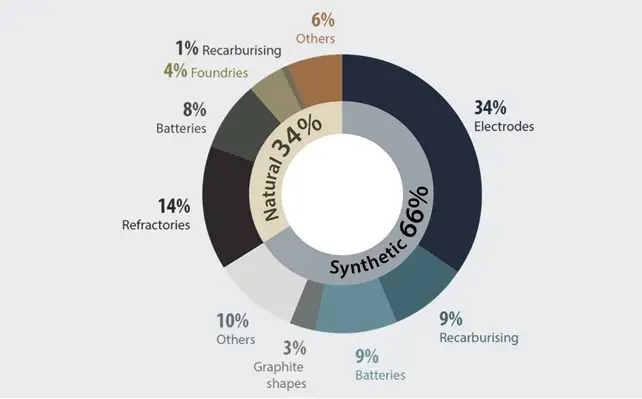

Carbon products are already used in many applications, from cores and crucibles to dry lubricants and electronic components. As the Canadians showed in this figure, in 2021, graphite was globally primarily used for electrodes, recarburising and batteries.

What fascinates me are new ways of using carbon in high-end products due to the development of new carbon products. I work as the Vice President, Carbon Products, in Hycamite, a company that decomposes methane into its essential elements, hydrogen and carbon. Our carbon products conduct electricity, which is why I see many opportunities in unique products that several industries increasingly require.

The world needs supercapacitors (SCs). SCs and batteries complement each other. SCs are electrochemical energy storage devices that store and release energy by reversible adsorption and desorption of ions at the interfaces between electrode materials and electrolytes. SCs can deliver energy ten times quicker than a battery, while batteries can provide ten times more energy over much longer periods than an SC can.

We already use SC technologies in various applications, from cameras to EVs. However, we cannot use them in as many applications as we would like due to several technological challenges. SCs discharge themselves more frequently than batteries and high equivalent series resistance limits their use to low voltage applications.

Just like in the case of batteries, new nanocarbon products may boost the development of technologies we need here. The energy storage occurs on the surface of the carbonaceous material used here as the active material. We can replace it with a carbon nanomaterial. This makes the surface area greater allowing larger capacity and improved energy density.

Natural graphite reserves are mainly in Turkey, China and Brazil

The Canadians are right about the concern about the availability of carbon products. Today’s factories simply cannot satisfy the need for industrial-quality carbon products, especially high-end ones.

Let us retake graphite as an example. Graphite occurs naturally in metamorphic rocks such as marble, schist, and gneiss. In 2021, global graphite reserves were estimated to be over 330 million tonnes. However, the resources are primarily concentrated in few countries. Turkey has the largest reserves of graphite. China is second and Brazil the third. Together these three countries accounted for 70% of the estimated world graphite reserves, as listed by the Government of Canada about the world reserves of natural graphite.

Canada ranks 9th globally for graphite reserves at 2% of the world total and the USA is not among the top 10 producers which creates a heavy dependency on export.

China dominates the global natural graphite market. In 2021, China exported almost 200,000 tons of natural graphite. Interestingly, Turkey exported just 2,500 tons of natural graphite in 2021.

China dominates synthetic graphite production

Manufacturers produce synthetic graphite through a complex process in which petroleum coke is baked at very high temperatures, between 2,700°C and 3,000°C in graphitisation. The term artificial graphite is often used as a synonym for synthetic graphite.

Manufacturers often favour synthetic graphite due to its higher purity and controlled specifications. Artificial graphite also offers a longer lifespan and a faster charge turnaround. The downside of synthetic graphite is higher costs and the high energy consumption of the production.

Synthetic graphite accounted for about two-thirds of the graphite consumption, concentrated mainly in Asia. China continues to dominate synthetic graphite production and demand globally. Synthetic graphite output is 68% Chinese while the country supplies 90% of the world’s anodes.

As the largest global producer, China naturally influences international prices. Many people also criticise China for polluting when producing synthetic graphite because Chinese electricity is mainly generated by burning coal.

We need more carbon product sources

My and the Canadians’ conclusions at the Toronto conference were clear: we need more sources of high-end carbon products. These products are becoming increasingly crucial to our development and most of all to our green transition. We need both better availability and less dependence on current producers. It is not only a matter of the price we must pay for carbon products we are running short of. We cannot afford the risk of intentional or unintentional delivery delays caused by political issues or accidents in global trade routes, like the Suez or Panama Channel.

Our green transition also needs more sustainable ways to produce high-end carbon products. We cannot allow a large carbon footprint even for carbon products. When we choose carbon products for industrial use, we must count the emissions the production has caused. Those are speaking strongly against the traditional ways of producing synthetic carbon products.

This article was originally published on LinkedIn. Read the original article here.