Synthetic graphite is critical for fast-growing battery production and several other industries. As the most common material that conducts electricity besides metal, and due to its high melting point of 3,400°C, the main use of graphite in the United States has been for electrodes in steel making , but this is changing. The major graphite boom is ahead of us because we need graphite for most types of batteries, including lithium-ion (Li-ion) batteries that power electric vehicles (EVs).

The synthetic graphite market size is estimated at USD 3.19 billion in 2024 and is expected to reach USD 4.44 billion by 2029, growing at a compound annual growth rate (CAGR) of 6.83% during 2024-2029. The price of graphite has tripled in the past 10 years, as production has been flat.

According to the U.S. Geological Survey (USGS), one single large Li-ion EV battery plant could require 35,200 tons of graphite per year for its anode material in battery packs. In 2021, American companies consumed 45,000 tons of natural graphite.

In a Li-ion battery, graphite is the negative electrode (anode) material. By volume, graphite is the largest component of EV batteries. An EV requires 10 to 15 times more graphite in a battery than lithium.

Natural and synthetic graphite have their own advantages

Industries started with natural graphite from ore deposits. Already in the 1890s, however, industries developed methods to produce graphite synthetically due to increasing demand, costs, potential instability of supply chains, and quality issues.

Natural and synthetic graphite have their own advantages and disadvantages as anode materials. Today, many battery manufacturers use blends to find the optimal balance between different advantages.

- Natural graphite has a higher charge-storage capacity than synthetic graphite.

- Natural graphite offers a lower cost because it takes significantly more energy to produce synthetic graphite than natural graphite. Synthetic graphite production requires high temperatures above 2,230°C.

- Natural graphite has between 62% and 89% lower greenhouse gas emissions.

- Synthetic graphite performs better in electrolyte compatibility and fast-charge turnaround.

- Synthetic graphite has higher purity, as well as greater stability, operating reliability and consistency.

- Synthetic graphite also has a longer life cycle.

The recipe for synthetic graphite requires natural, non-graphitic carbon

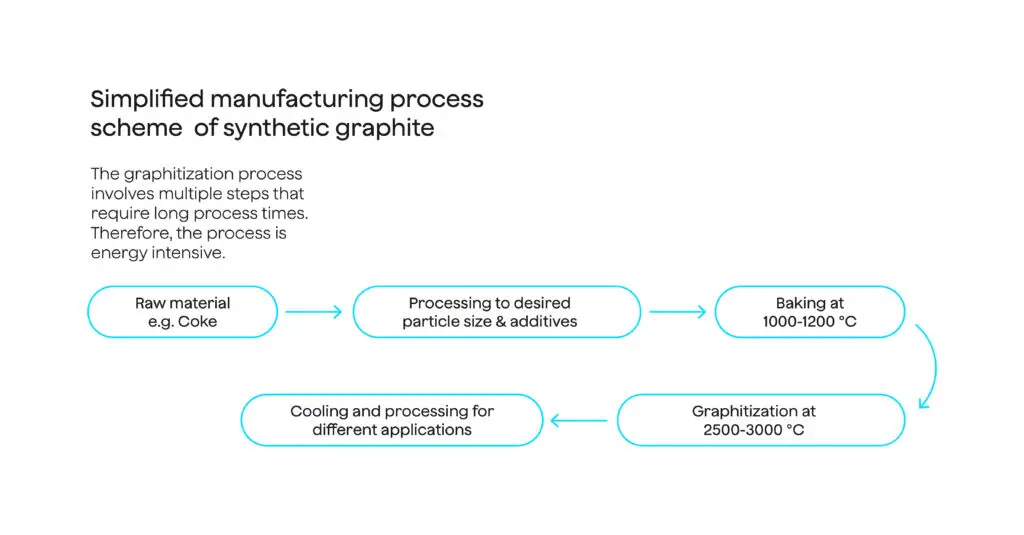

Synthetic graphite consists of graphitic carbon, which is obtained by non-graphitic carbon through high-temperature structural rearrangement of carbon atoms. To make anode-grade synthetic graphite, the value chain starts with producing non-graphitic carbonaceous materials, needle coke or pitch coke, at a petroleum refinery or a coal coking plant.

Here’s a simplified view of the steps to make synthetic graphite.

The preferred feedstock is needle coke from crude petroleum. Its fine-grained, needle-like structure is required to meet the high-purity and structural requirements for conversion into synthetic graphite. A cheaper alternative feedstock is pitch coke from coal tar, generated as a by-product from coal coking operations (carboning pulverized metallurgical coal in a reducing atmosphere).

A petroleum refinery often produces needle coke as a by-product of its oil refining operations:

- Production starts by recovering the residual oils that remain from extracting the lower boiling, lower molecular-weight, higher value components during the refining process of crude petroleum.

- The low-value residual oils are roasted in a coking furnace to drive off volatile components.

- The residual solid material, raw petroleum coke, is heated in a rotary kiln to burn off the volatile residual water and organic compounds. This yields calcined petroleum coke. Its carbon content is 97.0%-99.5%, and it is free of residual hydrocarbons and moisture.

- Only 5% of all petroleum coke produced becomes needle coke (acicular coke).

A tar distillation facility manufactures pitch coke by the carbonization of coal-tar pitch as a raw material withdrawn from the bottom of a distillation column:

- First water and then organic volatiles are removed.

- The dehydrated tar is mixed with a hot circulating pitch to yield a coal tar pitch.

- The coal tar pitch is heated in an electric furnace to bake the carbonaceous materials at 800°C-1,300°C into fine-grained pitch coke.

When needle coke or pitch coke undergoes graphitization, it is heated in an electric furnace at around 2,500°C-3,000°C to crystallize the aligned carbonaceous materials into graphite – requiring the largest energy input in the value chain. If fossil-based electricity is used for this process, then the carbon emissions increase substantially. Producers may need up to 4-5 months to attain sufficient crystallization of synthetic graphite; natural graphite requires 3-5 days.

Preparing synthetic graphite for battery anode applications also increasingly includes spheroidization to improve performance of the anode. First, graphite is first ground down. Then it is purified by high-temperature electrical and thermal treatment. The outcome is uncoated spherical graphite, which is subsequently coated and baked to yield coated spherical graphite. The current yield limitation for the spheroidization process is estimated at about 50%, both with synthetic and natural graphite.

Five manufacturers control global production

China dominates global synthetic graphite production and demand, even though graphite precursor manufacturing takes place worldwide. The growth of Chinese companies as synthetic graphite producers is accelerated by Chinese companies increasing rapidly as Li-ion battery manufacturers.

The top five synthetic graphite manufacturers control two-thirds of global production. The synthetic graphite market leaders are : GrafTech International, Resonac Holdings Corporation (Showa Denko KK), BTR New Material Group Co. Ltd, Shanshan Technology, and Lianyungang Jinli Carbon Co. Ltd.

China currently has a monopoly in spheroidization of synthetic graphite, a process that can improve performance of the anode.

Synthetic graphite production may damage the environment

Synthetic graphite production can seriously damage the environment if no significant protection investments are made. Manufacturing emits nitrogen dioxide, sulfur dioxide, and particulates from baking the hydrocarbon feedstocks. Earlier stages of the synthetic graphite value chain may pose serious environmental risks because of the carbon particulates, volatile organic chemicals, sulfur, and heavy metals.

High energy consumption can make graphite production very unsustainable. Tesla named graphite as one of the main contributors of CO₂ in their nickel-based battery supply chain – second only to nickel.

Energy-intensive graphitization grows in China because coal-fired plants generate cheap energy there. Producing 1 kilogram of synthetic graphite in China produces about 17 kilograms of CO2e, according to data collected by Minviro.

Methane splitting can change the graphite game

Every challenge has its answers, and methane splitting is a new piece of the puzzle in synthetic graphite production. Methane splitting is a chemical process that decomposes methane into its elemental components, hydrogen and solid carbon.

Some scientists call the process methane pyrolysis, and hydrogen produced this way turquoise hydrogen. The required process temperature and, thus, the amount of used energy can be significantly lowered by utilizing novel catalysts. Efficient, recyclable catalysts are already available.

Methane splitting provides industries with high-quality carbon products without significant emissions. The carbon footprint of the process is extremely low. There are no greenhouse gas emissions to the atmosphere during the process, and methane can be bought from responsible providers with low and controlled upstream emissions. Methane splitting even offers an opportunity to create carbon sink, when biomethane is used as a feedstock.

More reasons to consider methane splitting:

- Methane from natural gas, biogas or industrial side streams can be used as a feedstock. It is available globally, which can help reduce dependency on a small number of suppliers.

- Methane is available in large amounts, which makes it possible to provide the required amount of carbon products even when battery production multiplies significantly.

- An existing infrastructure is available for methane, which makes transportation and storage easy and affordable.

- Methane prices will remain affordable in the long run, due to the large global tapped and untapped reserves.

- Cost calculations are made more interesting by political measures, like the Inflation Reduction Act that incentivizes the use of domestically sourced graphite in American-made batteries.

- Hydrogen, a by-product, provides additional value for the methane-splitting industry.

We need new alternatives for current conventional synthetic graphite production to stabilize supply chains, meet growing demand, keep costs down, and protect the environment. Methane splitting can be the answer.

Niina Grönqvist, VP, Carbon Products of Hycamite, will attend NAATBatt 2024 in Carlsbad, California on February 19-22, 2024.

This article was originally published on LinkedIn. Read the original article here.

Sources:

[1]https://news.northwestern.edu/stories/2023/02/domestic-graphite-production-green-energy-transition/

[2]https://www.mordorintelligence.com/industry-reports/synthetic-graphite-market

[3]https://iopscience.iop.org/article/10.1149/MA2017-02/54/2282/meta

[4]https://www.forbes.com/sites/dipkabhambhani/2023/11/01/turquoise-hydrogen-producers-could-capture-flourishing-graphite-market/?sh=1e8a3d02495e

[5]https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/graphite-emissions-fuel-search-for-solutions-along-ev-supply-chain-69599516

[6]https://www.usitc.gov/publications/332/working_papers/gvc_paper.pdf

[7]https://www.usitc.gov/publications/332/working_papers/gvc_paper.pdf

[8]https://news.northwestern.edu/stories/2023/02/domestic-graphite-production-green-energy-transition/

[9]https://source.benchmarkminerals.com/article/esg-of-graphite-how-do-synthetic-graphite-and-natural-graphite-compare

[10]https://www.mordorintelligence.com/industry-reports/synthetic-graphite-market

[11]https://www.tesla.com/ns_videos/2021-tesla-impact-report.pdf

[12]https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/graphite-emissions-fuel-search-for-solutions-along-ev-supply-chain-69599516