The 45V tax credit is a key policy instrument to support the development and deployment of low-carbon hydrogen in the United States. To claim the highest credit of $3/kg H₂, hydrogen producers must demonstrate that their process emits no more than 0.45kg CO₂e/kg H₂. The definition of clean hydrogen and the eligibility criteria for the credit are still under debate, however, as the IRS and Treasury have issued proposed regulation that are open for public comment until today February 26, 2024.

As a leading player in the global hydrogen industry, Hycamite has been closely monitoring the regulatory landscape in the United States. We welcome the proposed regulation as a positive step towards creating a U.S. market for clean hydrogen. We believe the 45V tax credit will stimulate investment and innovation in low-carbon hydrogen technologies and help the country achieve its climate goals. We also believe the credit will help low-emissions hydrogen technologies scale up and become more mature, thus speeding up positive development globally.

Where industry stakeholders take issue

This recent regulatory development, however, has sparked intense debate among industry stakeholders. One of the most contentious issues is the proposal of the so-called “three pillars” for hydrogen production using electrolysis, a process that splits water into hydrogen and oxygen using electricity. The three pillars are:

- Incrementality (also known as additionality): The electricity used to produce hydrogen must come from zero or near-zero emissions power generation facilities having a commercial operations date no more than 36 months older than the hydrogen production facility.

- Temporal matching: The requirement that the electricity used to produce clean hydrogen must be matched with the electricity from the qualifying generator on an hourly basis. This is to ensure the hydrogen production reflects the temporal variability of the grid and the clean generation sources, and does not cause emissions spikes during periods of high demand or low renewable availability. The IRS proposes to phase in this requirement, starting with annual matching and transitioning to hourly matching in 2028. The IRS also proposes to use energy attribute certificates (EACs) to track temporal matching of the electricity used for hydrogen production.

- Regionality: The requirement that the electricity used to produce clean hydrogen must be delivered to the same region as the hydrogen facility. This is to ensure the hydrogen production does not cause emissions leakage or displacement in other regions. The IRS defines regions based on the North American Electric Reliability Corporation regions, which are large geographic areas that share similar electric power systems and reliability standards.

Why the three pillars matter

The three pillars are intended to ensure hydrogen production does not increase greenhouse gas (GHG) emissions from the electricity sector by displacing other renewable or zero-emissions sources and increasing the demand for fossil fuels. Currently, no region of the U.S. grid has a basic electricity generation mix clean enough to meet the requirements needed to claim the highest 45V tax credit (0.45kg CO2e/kg H₂)*. Therefore, it is important to ensure there is a methodology for calculating life cycle emissions that is feasible, practical, and consistent with the goal of reducing GHG emissions. The IRS also proposes to use EACs to track the emissions impacts of the electricity used for hydrogen production. EACs are tradable instruments that represent the environmental attributes of one megawatt-hour of electricity generation from a specific source. Taxpayers must obtain and retire them unless they want to use the emissions profile of the regional electricity grid.

The significance of the three pillars is further emphasized by a letter from the Environmental Protection Agency. Though the letter highlights it has not analyzed the life cycle GHG emissions associated with electrolytic hydrogen production, it does stress that Treasury’s anticipation of induced grid emissions from this hydrogen production are justified and should be considered in the life cycle analysis under the 45V credit. Moreover, the Department of Energy released a white paper, that not only explains how the three pillars would work in practice but also why the pillars are a necessary and reasonable approach to avoiding induced grid emissions in life cycle emissions accounting.

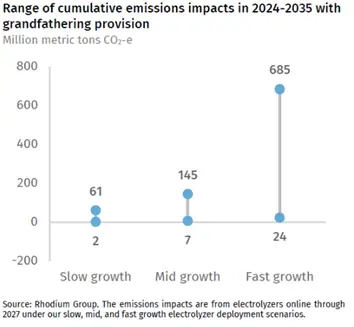

Using data from the Rhodium Group-MIT’s Clean Investment Monitor (CIM), Rhodium Group estimates that, given the proposed 45V credit, electrolyzers could reduce GHG emissions by 14-45 million metric tons (MMT) cumulatively from 2024 to 2035 under a mid-growth scenario of electrolyzer deployment, assuming the hydrogen produced offsets hydrogen currently produced by fossil fuel-based steam methane reforming. The mid-growth scenario presumes that the 4.7 GW of currently announced electrolyzer projects tracked in the CIM will come online through 2027. The emissions reductions could be higher or lower depending on the electrolyzer deployment scenario, the marginal emissions rate data, and the temporal matching flexibility.

Some organizations argue hydrogen facilities that commence construction before 2029 should not be required to meet the hourly matching requirement for the life of the facility (a term called grandfathering), as this would provide more certainty and flexibility for project development. Grandfathering is not allowed in the proposal; therefore, all facilities should meet all eligibility criteria in 2028. According to the initial analysis by Rhodium Group, grandfathering could lead to an increase in systemwide cumulative emissions that could be as high as 685 MMT under a fast growth deployment scenario (see Figure 1).

Figure 1. Impact of grandfathering

It has also been argued that hydrogen producers could take advantage of instances where existing clean resources are underutilized. Senior Energy Analyst Julie McNamara outlines that these periods are, “typically geographically specific, in the case of curtailments, or plant-by-plant specific, in the case of pending retirements or relicensing, or state specific, in the face of pre-existing policies that defend against system-wide emissions increases.” Regarding this, the IRS has requested comments based on options for allowing a portion (5% or 10%) of the existing zero-emitting generation fleet to qualify for the 45V credit. In such a scenario, the Rhodium Group estimates that, net emissions may decrease by 101 to 179 MMT through 2035, provided generation is diverted to hydrogen production only in periods having very low marginal emissions rates. If generation was diverted during the dirtiest hours of the grid, the net systemwide emissions could increase by nearly 1.5 billion metric tons through 2035. As clean hydrogen is needed to decarbonize industries, we at Hycamite believe it is essential for the IRS to provide clear guidelines that avoid such extreme consequences.

How methane can be better addressed

One of the compelling features of the proposed 45V regulation lies in its technology-neutral approach. It prioritizes decarbonization over technology. As a developer of new low-emissions technology to produce hydrogen, we at Hycamite appreciate this approach, particularly given the prevailing focus in the EU on hydrogen production via electrolysis using renewable electricity. Consequently, Hycamite has been actively exploring opportunities to produce emissions-free hydrogen from methane splitting in the United States, collaborating with NW Natural in Oregon, for example.

With regards to methane, however, we have identified necessary changes needed in the 45V proposed regulation to better calculate the carbon intensity (CI) of hydrogen produced using methane as a feedstock. In the 45VH2-GREET model to be used for calculating the CI of 45V-compliant hydrogen, the upstream methane emissions rate is treated as background data, limiting user flexibility to adjust it for accurate CI representation. Recognizing that methane emissions rates vary across suppliers, Hycamite advocates for a more customizable approach. If users can verify data, they should be able to input supplier-specific methane emissions rates into 45VH2-GREET. This approach would further support the use of responsibly sourced methane and as a result, help decrease methane emissions.

Furthermore, the current 45VH2-GREET model does not include methane splitting technology (also referred to as methane pyrolysis), which Hycamite and several other companies specialize. This technology allows for the direct conversion of methane into hydrogen and solid carbon. By including methane splitting in the model, we can accurately assess the CI of hydrogen produced from methane feedstock. This is a sentiment shared by other key methane pyrolysis companies.

The 45V proposed regulation lacks rules regarding the use of renewable natural gas (RNG) or fugitive sources of methane, something that the regulation was transparent on. The IRS requests comments on the use of certificates for RNG and fugitive methane. The preamble to the proposed regulation states, however, that for biogas to receive a low emissions value for claiming 45V tax credits, it would need to originate from the first productive use of said biogas and biogas-based RNG or fugitive methane. We trust the IRS will provide rules that avoid induced emissions from diverting RNG and/or fugitive methane from their previous use.

Conclusion

Overall, the 45V tax credit could stimulate the nascent clean hydrogen market in the United States, by making clean hydrogen competitive with conventional hydrogen and driving down the costs of clean hydrogen technologies. When successful, the credit will also enable companies in U.S. markets to expand their businesses internationally. The proposed regulation provides a clear roadmap for how to claim the lucrative tax credit, which is critical for supporting investment and innovation. It is, however, critical for the IRS to address the role of existing clean generation in a way that does not erode emissions benefits, causing more harm than good.

The final regulation will have a significant impact on the future of clean hydrogen in the United States, as well as broader decarbonization efforts. The IRS should carefully consider the feedback from stakeholders and the analysis from experts and strike a balance between providing certainty and flexibility for the clean hydrogen industry and ensuring the environmental integrity and effectiveness of the 45V tax credit. We at Hycamite understand that this is not easy to do with hydrogen produced via electrolysis due to its high energy intensity per kg of produced hydrogen. However, the regulation should be clear and give no possibility to work around it to get support for producing hydrogen with high emissions. Therefore, we believe that the three-pillar structure is the best so far.

References

*How Clean Will US Hydrogen Get? Unpacking Treasury’s Proposed 45V Tax Credit Guidance | Rhodium Group (rhg.com)

Guidance on Section 45V Clean Hydrogen Production Tax Credit | King and Spalding

A&M Tax Reports on Section 45v Proposed Regulations | Alvarez and Marsal

Proposed Electrolyzer Requirements for the Hydrogen Tax Credit: Strengths and Risks | Julie McNamara