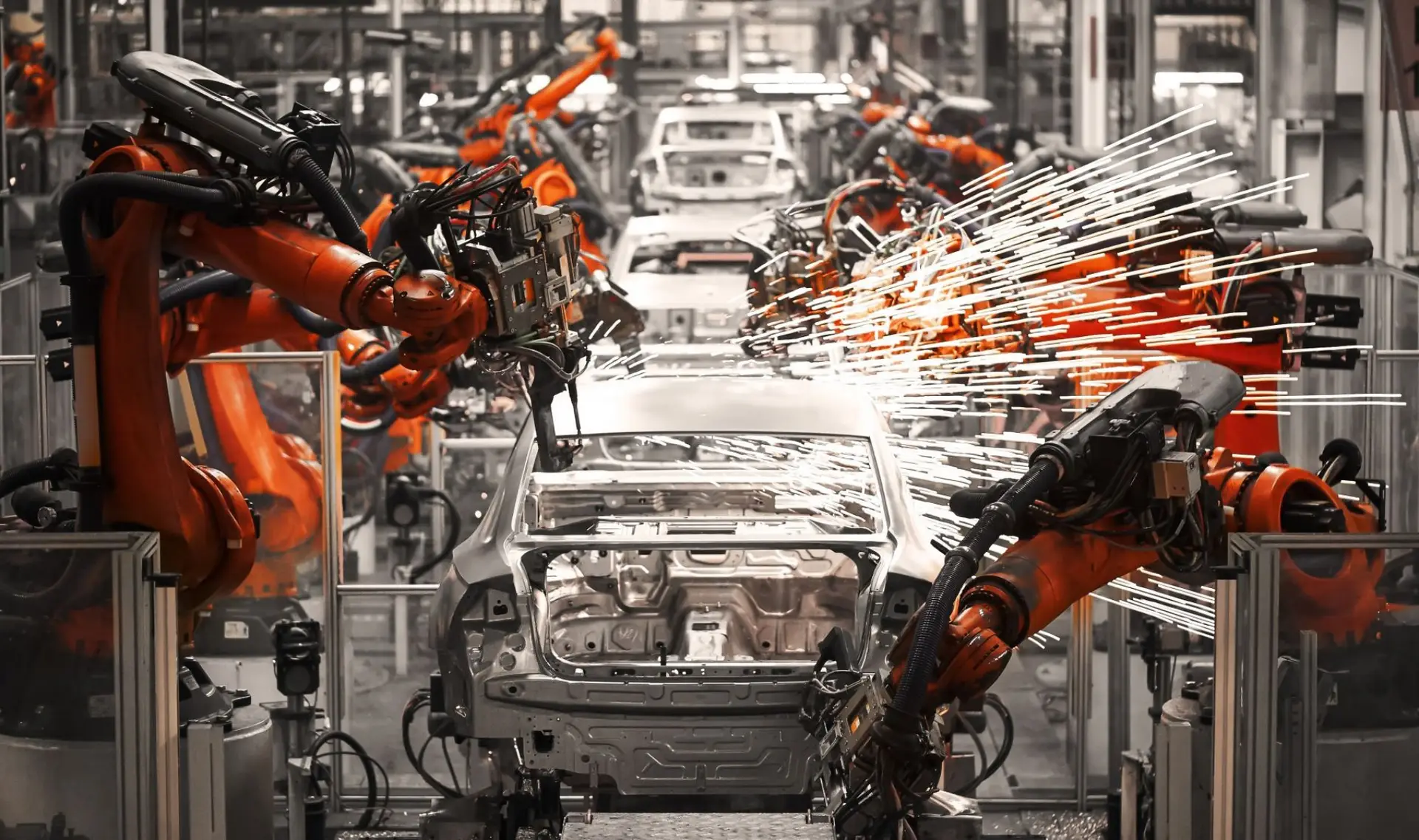

Electric vehicles are slowly taking over the global car market. Electricity storage system markets are booming. The winners of market change will most likely be those companies who can provide their clients with the most reliable, durable, and economical batteries on the required scale.

Currently, carmakers, as well as most producers of fuel cells, consumer electronics, and other electricity storage applications, rely on lithium-ion batteries. Even though other battery options may soon emerge, the manufacturing of most batteries currently requires high-quality carbon, making it a vital raw material.

Electrode materials are the key factors that restrict the performance of lithium-ion batteries. Among them, negative electrode material has a significant influence on the electrochemical performance of the lithium-ion battery. In lithium-ion battery anode material, carbon has the advantages of low electrode potential, high cycle efficiency, long cycle life, and good safety performance. Therefore, carbon is the preferred anode material for lithium-ion batteries.

Synthetic graphite excels in quality

In anodes, battery manufacturers use mostly a specific form, or allotrope, of carbon—graphite. Battery manufacturers can also use other carbon allotropes and their mixes. For instance, we may start to see much more graphene and carbon nanotubes being used in batteries because of their unique physical properties. The particular allotrope used in an anode is not the concern, but how the material properties of the anode meet the battery manufacturer’s needs in each case is important.

Carbon is easy to find because it is everywhere, being the 15th most abundant element in the Earth’s crust. The challenge lies in the quality. When Mother Earth was creating carbon deposits and started to embrace them close to her cover, she did not have the needs of battery factories in mind. The quality of natural graphite varies even within one deposit, and impurities inside natural graphite may lead to shorter-lasting batteries. To meet a battery manufacturer’s specifications reliably, synthetic graphite and suitable pure carbon mixes are often safe choices. Purity and stability are some of the qualities of synthetic graphite currently causing its demand to increase across various application segments of graphite.

Local graphite production ensures constant production

On March 23, 2021, the container ship Ever Given was traveling through the Suez Canal and got caught in a sandstorm. The captain lost the ability to steer the ship, and the vessel turned sideways and blocked the channel. As supply chains are now global, this one small incident caused severe shipping delays all over the world for a long time.

A crisis in logistics can get much worse. The coronavirus epidemic has interfered with global supply chains considerably more than even several ship incidents could ever do. The supply chain crunch will likely last into 2022 as the surging Delta variant upends factory production in Asia. Manufacturers reeling from shortages of key components and higher raw-material and energy costs are being forced into bidding wars for space on vessels, pushing freight rates to record highs. Additionally, several exporters are raising prices or canceling shipments altogether.

China alone accounts for around 60% of the world’s graphite production. In 2019, the country had more than 90% of the world’s supply of amorphous graphite and around two-thirds of flake graphite supply. Flake graphite is a raw material vital for use in lithium-ion battery anodes and a key mineral for the success of the booming EV sector. Furthermore, 100% of flake-graphite processing that produces lithium-ion battery grades (spherical graphite) takes place in China.

Therefore, the European Union considers natural graphite a critical raw material with a high risk of supply shortage. If you manufacture electric cars in Europe, a scenario like one single volcanic eruption in the Malacca Strait or a terrorist attack in Suez Channel might cease your factories. The lack of chips caused by the current logistics disruption has already led several car manufacturers—among them, Ford and General Motors—to cut production in several plants.

In the past, many companies underestimated their risks related to the global supply chains. Now they meet the challenge by bringing raw material and component production again close in proximity to their factories. For instance, this summer, Bosch opened a chip factory in Germany. German salaries are surely higher than in Asia, but the security of supply and high quality renders the decision smart from a business point of view.

Ruining the environment is costly

The African region is expected to be the next hotspot for the mining of natural graphite. With the recent slowdown in the Chinese economy and increase in costs, many companies are considering relocation to African regions to meet their natural graphite demand at lower costs. While China is currently the main producer of graphite, the largest deposits of high-quality natural graphite in the world are located in the Mozambique graphite mine.

First, of course, we believe mining can be executed responsibly. If you follow strict standards, the negative environmental impact can be minimized, and controlled mining can help to end the use of fossil fuels faster. However, a large share of the world’s natural graphite mining is not currently conducted according to the best environmental standards. The weak governmental control in mining areas and issues with supply chains may lead to even worse environmental damage in natural graphite mining.

For instance, several electric car manufacturers are now searching for opportunities to use fossil-free steel to emphasize the sustainable aspect of their new vehicle production. Showcasing your green side is a great idea—until the world learns the mines you source for your batteries’ raw materials are damaging the environment. Mining costs may suddenly become very expensive to manufacturers. Just think of the scandals we have already seen with cobalt mining in Congo.

Sustainability and the right prices require innovations

Synthetic graphite has so far competed with its quality. We now need innovative solutions to produce high-quality solid carbon with the required physical properties and in the vicinity of the manufacturer using the material. A risk-free distance to the source of solid carbon can yield competitive prices. University research has helped to meet the challenge.

The environmental problems related to natural graphite production do not necessarily mean that synthetic graphite is a sustainable alternative. Synthetic graphite is a man-made substance manufactured by the high-temperature processing of amorphous carbon materials. The many types of amorphous carbon used as precursors to graphite can be derived from petroleum, coal, or natural and synthetic organic materials. In many cases, synthetic graphite production has led to significant carbon dioxide emissions. This must stop, which can happen once we have solutions for environmentally friendly, high-quality solid carbon.

Commercial Director Niina Grönqvist at a laboratory where methane is decomposed. Hycamite TCD Technologies has recently launched a test facility for hydrogen and pure solid carbon production in Kokkola, Finland.